The Step-by-Step Process I Used to Select my 401k Investments, Even Though I Would've Preferred to Claw My Own Eyes Out

The Step-by-Step Process I Used to Select my 401k Investments, Even Though I Would've Preferred to Claw My Own Eyes Out

Raise your hand if you’ve ever felt personally victimized by a snooze-worthy company-wide meeting on HR policy and updates.

My employer recently switched our 401(k) provider, which is great because the fees from the old provider were pretty steep, but it’s not great because that means I sat through a meeting so dull it made waiting in line at the DMV seem thrilling.

Since our company made the switch though, I need to get up in there and review my account. I’m way overdue to do that, anyway.

Wait, what’s a 401(k) again, and how much should I be contributing?

If you haven’t already, read this 401(k) overview post first, then pop back over here for the rest!

As a reminder, your 401(k) is not the actual investment that will grow on its own and float you into retirement; it’s the shell that holds the investments.

Remember how we talked about how having a “mutual fund” is like a gift basket?

The mutual fund is the basket, while the individual cookies, fruits, cheeses, pears and those weirdly dry crackers that nobody actually likes are the various investments that go inside of the basket. Similar situation with a 401(k). You have to actually select where you want the money that is funneled into your 401(k) to be invested.

When you’re just starting (or reassessing, like I am), it can feel like you’ve just been told to navigate a ship to the center of Omaha, and to do it without a compass. I need resources, I need answers, I need help, cause I don’t know where to start.

What do I choose? What are all of these weird acronyms? What’s a ticker symbol, and why should I care?

For the record, I’m not trying to offer specific investment advice*. Ahead, I’ll compare two fund options, but it’s worth noting that this exercise is intended to clarify WHAT it is you should even be looking for in a 401(k) — not which fund you should definitely choose. I just hope it helps de-timidate (real word) investing so that you can get some skin in the game.

I can’t tell you what absolutely everything means, but I can tell you what the top-most considerations are when you’re just trying to get the 401(k) ball rolling in the right direction. Here are four:

Expense ratio

Basically another word for overhead fees — administrative costs, paying for the ad campaign to get you to invest in it, etc.

Fees

These can sneak up on you. A 4% management fee may not seem like a lot right now, but what about when you’ve racked up $50,000 in that account? It adds up. Fees aren’t entirely avoidable, but with lots of competitors vying for your investment money, it’s worth weighing the fees against each option!

Composition/Goal of fund

Is it comprised mostly of stocks? Bonds? Is the goal wealth preservation or growth? Is it aggressive and risky investing for maximum long-term opportunity?

Long-term performance

How’s it done over the last 10-15 years?

The fund my 401(k) is currently invested in is the Vanguard 500 Index Fund Admiral Shares. On the American Funds site (my employer’s chosen retirement account platform), they have this list of all of your investment options. When I click on the overview for the fund, I can quickly compare those key considerations listed above^.

OK, let’s dive into the comparison of key considerations for two fund options.

First up, my current selection of Vanguard 500 Index Admiral Shares.

Once you click that, you can see an overview of what kind of stocks are in the fund, how it’s historically performed, and what you can loosely expect to see as a return on your investment (based on what it’s done in the past — obviously nothing is guaranteed in the stock market).

Here’s that overview page I get when I click on “View” for the fund.

I want my expense ratios like Flo Rida wants his shawtys: low.

I have a very sophisticated and advanced way of researching how much my expense ratio should be. Do not be intimidated if you can’t keep up. Here it is:

I just … Google it.

I do some reading.

I don’t try to solve every equation, I just try to get a loose picture of what’s horrific and what’s standard for expense ratios for this kind of account.

Turns out, anything less than 1% is a good start. Obviously, the lower the better. Vanguard is known for their incredibly low expense ratios and fees, and 0.04% is super duper low! Like lower than the movie ratings for The Green Lantern, low!

Here’s the summary of that same fund from above, the Vanguard 500 Index Fund Admiral Shares:

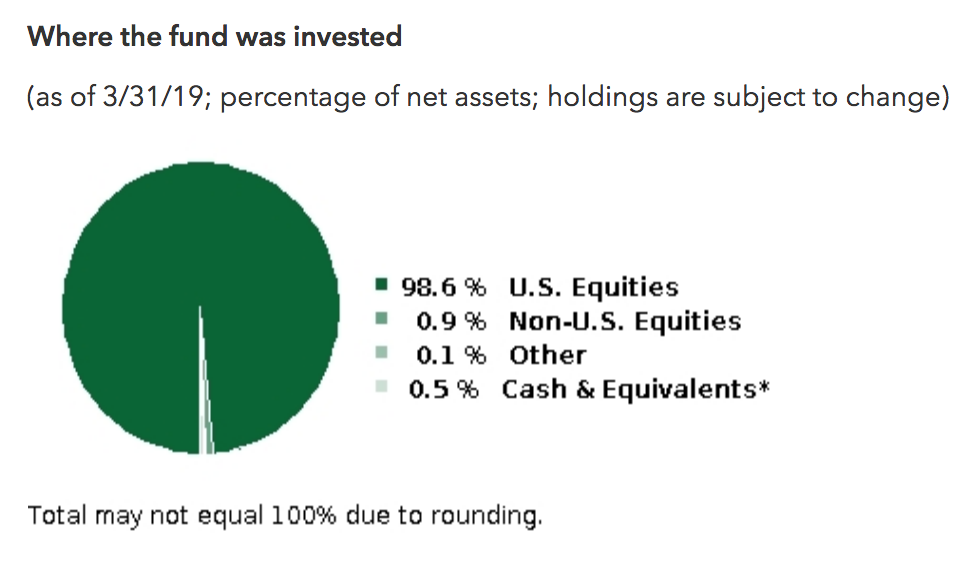

98% of the fund goes to American stock.

Remember: I’m not trying to get into the super nitty gritty details, beat the market or — heaven forbid — do any mental math; all I’m looking for here is a brief comparison of my best options.

Is the fund doing what it’s supposed to be doing (which is tracking the index)? Is it about even with the S&P? The main thing I’m looking for here is that it’s not wildly below the index that it’s tracking.

And look:

It’s about even with the benchmark.

Next, I check out what the top holdings are. Not that I particularly care (you might, though!), but I’m just curious what I’m investing in.

And here are the top ten largest holdings:

See that? I’m not JUST investing in those ten, but those are the largest in the portfolio in which I’m investing.

By the way, the last two graphics were unavailable (or “N/A”) on my American Funds site for whatever reason. But, I just Googled the fund name (Vanguard 500 Index Admiral®) and it was the top hit on the Vanguard site. Easy peasy.

Vanguard 500 Admiral Shares Summary: Super low expense ratio, promising long-term growth and fund composition I can get behind.

Next, I compare the big picture from that fund with the big picture from this Target Date 2055 fund.

Wait, whaddup with Target Date Funds?

The main idea behind a Target Date fund is pretty simple: Have more invested in “riskier” stocks when you’re young (and you have decades to recover from any potential losses), and gradually shift that allocation to “safer” options like bonds as you get closer to retirement (since you’re SOL if stocks crash and you need your retirement fund in two days cause you’re 64 and buying a boat, for example).

Here’s a look at the Target Date 2055 fund:

As you can see, the expense ratio is significantly higher with this option, and it makes pretty good sense why. With such a diversified account, there’s simply more management: more buying and selling, more rebalancing as the user ages toward retirement, more everything. So it costs more.

A few benefits to that:

It’s on auto-pilot.

You don’t need to rebalance your account as the market fluctuates, no need to convert from risky stocks to safer bonds as you age since that’s done for you.

There couuullldddd be more potential to make more money since younger (or “risk-willing”) participants have access to higher risk/higher reward accounts.

For example, this Target 2055 includes international and small-cap investments, while investing in Vanguard 500 Admiral Shares is basically just investing in the 500 biggest American companies.

I’m in my 20s. I can take risk with my investments. But I really hate fees. And the Target 2055 has higher fees.

But that’s not enough information to make my decision.

Let’s loosely compare the last 10 years of performance from both accounts.

Vanguard 500: 15%

Looking at the 10 year history for VFIAX … a 15% return would be clutchhhhhhh in any market setting.

Versus…

Target Date 2055: 10%

Growth overview - Target Date 2055

Target Date 2055 fund - roughly 10% growth over the last ten years.

Currently, my portfolio is moderately balanced, I’d say. I don’t hold international investments — I track the S&P 500, the 500 largest 500 American companies.

Although wow, “international investments” sounds so freaking exotic and cool. I may need to switch it up just so that I can flip my hair and say in my most posh voice, “Oh yes, well my global investments were up this year, so that’s positive. More caviar, dear?”

So which way did I go?

I stayed with the Vanguard 500 Admiral Shares. Lower fees, higher historical returns, and I can always rebalance/adjust as I near retirement.

But wait! There’s more!

One more thing to do while you’re up in your account is make sure that you’ve added a beneficiary — someone (usually a spouse, parent or family member) who gains control of the fund in the event of your death.

Why Should I Add a Beneficiary?

In case I get hit by a bus, or, more likely, run over by a horse carriage in downtown Charleston, my husband will gain control of the fund. If you don’t add anyone, your money could get tied up in probate court, where a judge will decide how to distribute it. Zoiks!

Here’s how my online account works; yours is probably similar (or at least has similar buttons to hit!).

Then, it pulls up a new screen and asks a series of like two questions.

So, this step doesn’t take long AT ALL, and you should do it on each of your investment (and general banking) accounts. A few minutes of extra prep now can save a major headache for someone later. But not you. Cause you’ll be dead.

In closing, let me leave you with these wise words:

“Don’t be scurred. Just start” — SC

When you’re figuring out your 401(k), the most important thing isn’t to make sure you have the ABSOLUTE best, most advantageous, most well-researched, fool-proof investment selections. The most important thing is to START.

Just start now, and you can adjust later. It sounds like pretty terrible advice, but sometimes, it’s the most pragmatic.

RELATED READ: Where Should I Start With My Money Problems?

As I mentioned above, dealing with my HR department or 401(k) in any capacity is like slowly raking the softest part of my abdomen across jagged shards of metal.

But when it comes to boring, soul-sucking tasks, you just have to get it done before you can push it off.

Because I would do that.

If I didn’t have the nudge from my dad, I may have delayed and delayed and delayed and looked up when I’m 43 and will be opening that retirement account annnnyyy day now. I’m lucky, because I had my parents to help motivate me and guide me when I first started this job out of college. I distinctly remember asking my dad if this one fund was the right choice, and he said, “If it’s not, you can change it later. Just get it in there now, and earn that 4% match.” And he’s right. I wasn’t 100% positive how much of my salary I should contribute to my 401(k), or which exact fund I should select. But I sure am glad I didn’t wait to figure out every single detail of every account before I started earning free money from my employer.

So this is me, nudging you. Don’t let the pressure of this task overwhelm you to a point where you are paralyzed.

Start now, so we have enough money to party together like it’s 1999 when we’re 99 :D

Cheers to that.

OK, question time: What’s on the top of your list of things you want to have plenty of money for when you’re super old? Topping my list: Freedom to spend my days how I want, picking up the check when I spy cute high schoolers on a first date across the restaurant, sponsoring a merit-based scholarship for a ballet student of my choice, the entire sleepwear line at Soma. Your turn! Sound off in the comments!

*Disclaimer: As a reminder, I am not offering investment advice. This site exists for entertainment purposes, and you should do more research and talk to your financial advisor to make the decision that’s right for your situation. :)