Is Venmo Free? (Or Are You Paying Hidden Fees?)

Forget keeping tabs your ex’s Insta stories, Venmo is the creepiest way to see what someone is up to.

Trust me — this is the future of social media stalking.

You can find out some juicy gossip via Venmo. Who’s hanging out? Who’s late on paying their half of the electric bill? Why have I been scrolling through this app for four full minutes of my life and why do I care that the guy who did a group project with me in JOUR 401 paid for wings at a Chiefs game?

Help.

I’ve fallen into a black hole and I can’t get up.

I know I lean toward the side of Crazy Doomsday Freak Who Doesn’t Trust Social Media And Thinks We Should Bury Money In the Backyard, but COME ON PEOPLE! For the love of Bruce Willis, set your Venmo exchanges to private! Why would you invite the whole world to see that you paid Christina back for margaritaassssss!!!! 🍹Or that Jake paid you back for chicken fingers at 3 a.m. You’re just asking me to draw my own conclusions there, friend.

Of course, I’m not naive enough to believe that any social media is private. Even when the settings are set to private, there’s a record somewhere. (If you think all those Snapchats are just disappearing into the abyss, I have bad news for you.)

Social media puts me on an ethical seesaw.

Are we all just deeply narcissistic and need to share our lives because we think we’re important? Or is it a truly life-changing way to connect with a long-lost friend? Is it a means of news sharing and story spreading? Or is it just one more place for evil to take place? Is it contributing to mental health issues? Is it a totally necessary means of connecting with others as a blogger — especially an anonymous one?

Can it be all of the above?

And what does it mean when we introduce our money to the medium?

I think there’s a whole lot of gray in this area. And that makes sense — it’s all new. But I’d rather play it on the safe side and put up as many boundaries, barriers and time limits on my usage as is reasonable. Which is tough, especially when I’m at a crowded rooftop bar with eight people and it’s time to close out.

“You pay; I’ll Venmo you.”

How many times have you heard that? Venmo has become a verb, it’s so popular now. But at what cost?

Let’s review.

What is Venmo?

As the Paypal of our generation, Venmo is a peer-to-peer money transfer mobile app. Unlike many of its marketplace counterparts, Venmo makes transactions as easy as sending a text message — and with just as many emojis, too. In other words, it adds an element of socializing to a commonplace money transaction.

Similar to a Twitter or Facebook feed, your “friends” — which don’t have to be requested, but automatically populate based on the contacts saved in your phone — and their money exchanges show up on your screen.. You can set your transaction to private (hi — do this), though dollar amounts are not visible to viewers in any setting.

How does Venmo work?

Venmo can be used for money transfers between individuals, and also for business purchases in some settings. When you set up the app, you connect it with a credit card, debit card or checking account. Then, you can use it to send or request money to/from anyone who also has a Venmo account. From a technical standpoint, the app has a programming interface extension that businesses and websites can use.

RELATED READ: How Much Should You Contribute to Your 401k? (And Should You Even Have One?)

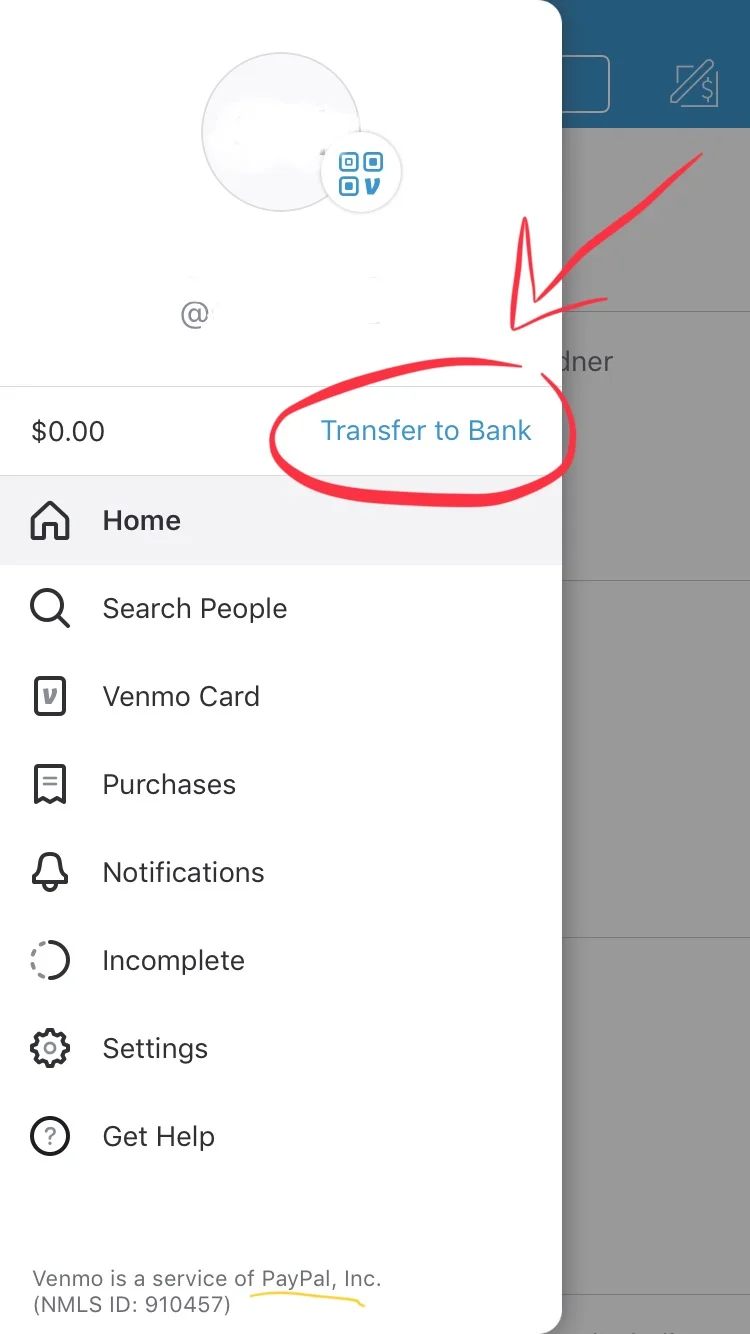

How does money get from Venmo to my bank?

Think of Venmo like the middle man.

As the middle man, Venmo’s job is just to hand off money from one person to another.

It’s crucial to remember that Venmo stores any money you receive in the app. It’s not the middle man’s job to automatically deposit that money into your bank account for you. That means that if you send money to a friend but they never transfer it to their bank account, the money won’t actually come out of your bank account. At that point, only your Venmo balance is changing.

To transfer the money into your actual bank account, you must go in the app and manually initiate it. Here’s how:

How long does it take my money to transfer from Venmo to the bank?

Allow up to two business days for your money to transfer from your Venmo account into your bank. If you use a major national bank, that time frame will likely be shorter. Smaller, more local banks may take a little longer.

Is Venmo safe? Is my money secure with Venmo?

The short answer is: No. It’s an app. It’s your most personal information stored in a digital format, of course it’s not secure.

But, the app has a two-step security feature, including a PIN number and/or a fingerprint login option. If your phone is stolen, you can change your access on Venmo’s website.

Quite frankly, you just have to do your research and decide if it’s worth the risk for you. Venmo does not have a squeaky-clean history — AKA, there have been security slips and hacking incidents in the past.

Fortunately, the security has been tightened a lot since most of the shenanigans went down pre-2015. In fact, in February 2018, The Federal Trade Commission reached a settlement with PayPal in to officially address these problems.

What can you do to help keep your Venmo secure?

For starters, always confirm that you’re sending your money to the correct username. It seems simple enough, but if your money goes to a username that is off by one number, you’re out of luck.

Another idea is to set up a free checking account exclusively tied to Venmo, so that if it were comprised, only that money would be in jeopardy.

In the end, it’s up to you to decide if you’re comfortable using the app, and to check your accounts daily/every other day just to check in and make sure everything looks correct.

Does Venmo cost money?

Yes and no. There are two main fees associated with Venmo, but there are ways to get around them.

Fees associated with Venmo:

Instant transfers — If you transfer money from Venmo into your bank account and want to have access to the money within 30 minutes, it costs a flat fee of 1% (or a minimum of 25 cents) of the transaction.

Transactions funded by a credit card — this requires a whopping 3% of the transaction. The exception to this is when a merchant/business has a Venmo option — the credit card 3% fee does not apply to you here.

If you don’t want to get smacked with a fee, the standard two-day transfers don’t cost you anything. For now.

Who owns Venmo?

PayPal.

Is Venmo cryptocurrency?

No.

Venmo is not actual money — it’s not a digital version of legal tender. It’s a “mobile money service” that moves your money, not actual money.

What are the social implications of Venmo?

I think we’re still finding out what all of this means in our day-to-day lives. On the one hand, everyone’s dependency on the digital world makes us vulnerable. On the other hand, it sure does make life easy sometimes — and even makes money conversations less awkward. After all, it’s so much easier to send a Venmo request with a line of cute heart emojis and smiley faces than actually use our words and say, “Hey can you hit me back for the hotel room I paid for on the bachelorette trip? I have to pay rent and we can’t all skate through life like you, Karen.”

RELATED READ: Here’s How To Make the Most of Your Mental Bandwidth

There’s a convenience factor — there’s no denying that. And if it helps you, that’s awesome — but just keep a close eye on your account and make sure there’s no funny business going on. Venmo is so commonplace now that it’s easy to forget that it’s tied to real money with real implications. Do your part to make sure your money is safe!

Have you ever used Venmo? Do you now prefer it? Have you ever had any problems? Let me know in the comments below!